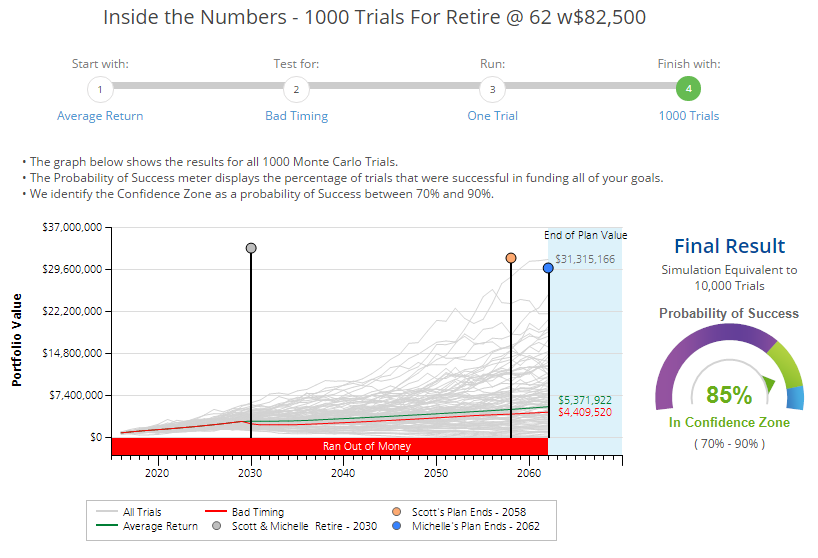

Probability Analysis

Disclosures:

The projections or other information generated by MoneyGuidePro regarding the likelihood of various investment outcomes are hypothetical in nature and do not reflect actual investment results. The plan results vary with each use and over time and are not guarantees of future results.

The results of all simulated trials are used to evaluate and describe a hypothetical distribution of outcomes, but do not represent a forecast or prediction of actual expected investment or financial outcomes.

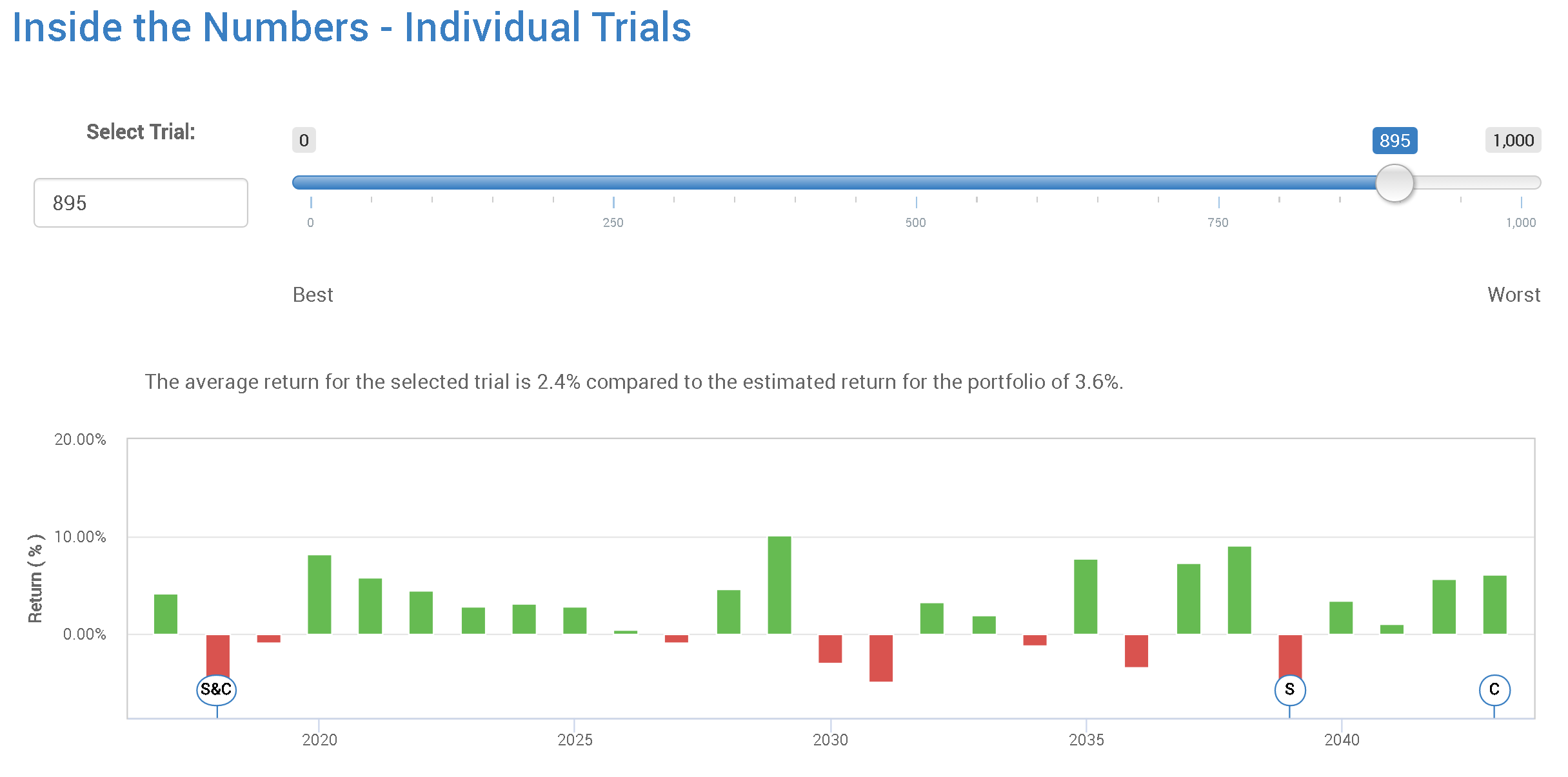

Despite our best efforts to project the road ahead of us, life is volatile and there is no crystal ball. Why are we content with financial plans that attempt to project the future using a fixed, average rate of return and a fixed rate of inflation? In reality, these rates will vary from year-to-year. Plus, the average return of your portfolio in retirement is not nearly as important as the order, or sequence, of your annual returns during retirement. This is known as ‘sequence of returns risk’ and is the reason why two retirees with the exact same average return over the same number of years can have wildly different outcomes, depending on the order of their returns. When we try to turn a financial plan into a crystal ball by predicting rates of return and inflation, we attempt the impossible – all while knowing the actual outcome will differ from the projected outcome 100% of the time!

Instead of relying on a single, average return, we rely on probability analysis software (“MoneyGuidePro®”) from PIEtech℠ to measure your financial strategies against simulated market performance over thousands of lifetimes. Analyzing your situation across a variety of random outcomes, over thousands of lifetimes gives us a high level of confidence regarding how likely you are to accomplish your financial objectives. Consistently repeating this approach over a number of years can increase your confidence and bring clarity to current & ongoing financial decisions.