Diversification is a common technique to manage risk by combining a variety of investments inside of a portfolio. The idea is to select assets that react differently to various market factors in an effort to reduce the overall volatility of the portfolio. In our experience, a portfolio that lowers volatility within your specific risk profile tends to be easier for clients to stay invested in through the ups and downs of the market. Staying invested can have a positive impact on portfolio fees and long-term performance. Please keep in mind that many investments involve risk and diversification does not protect against market risk.

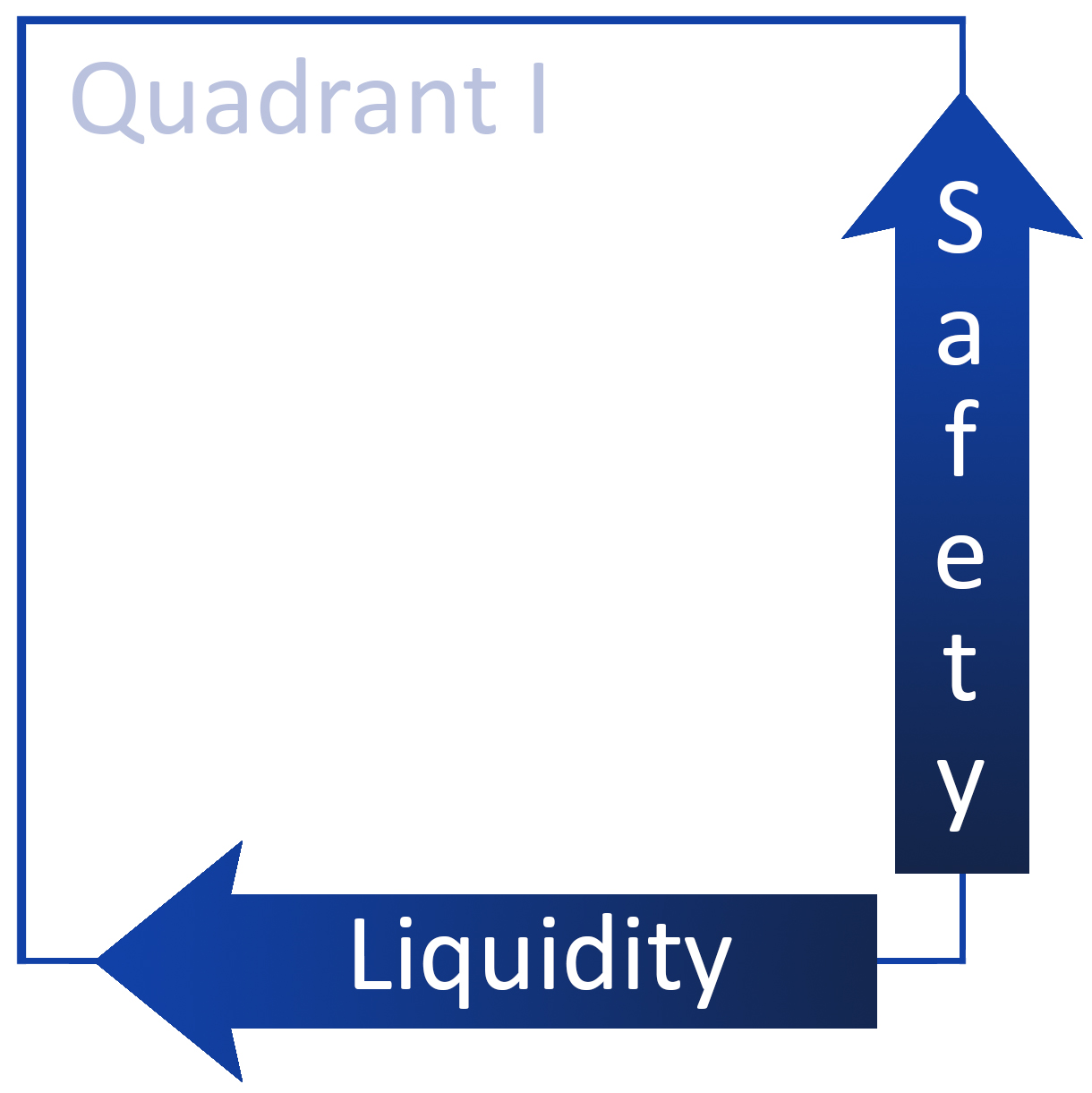

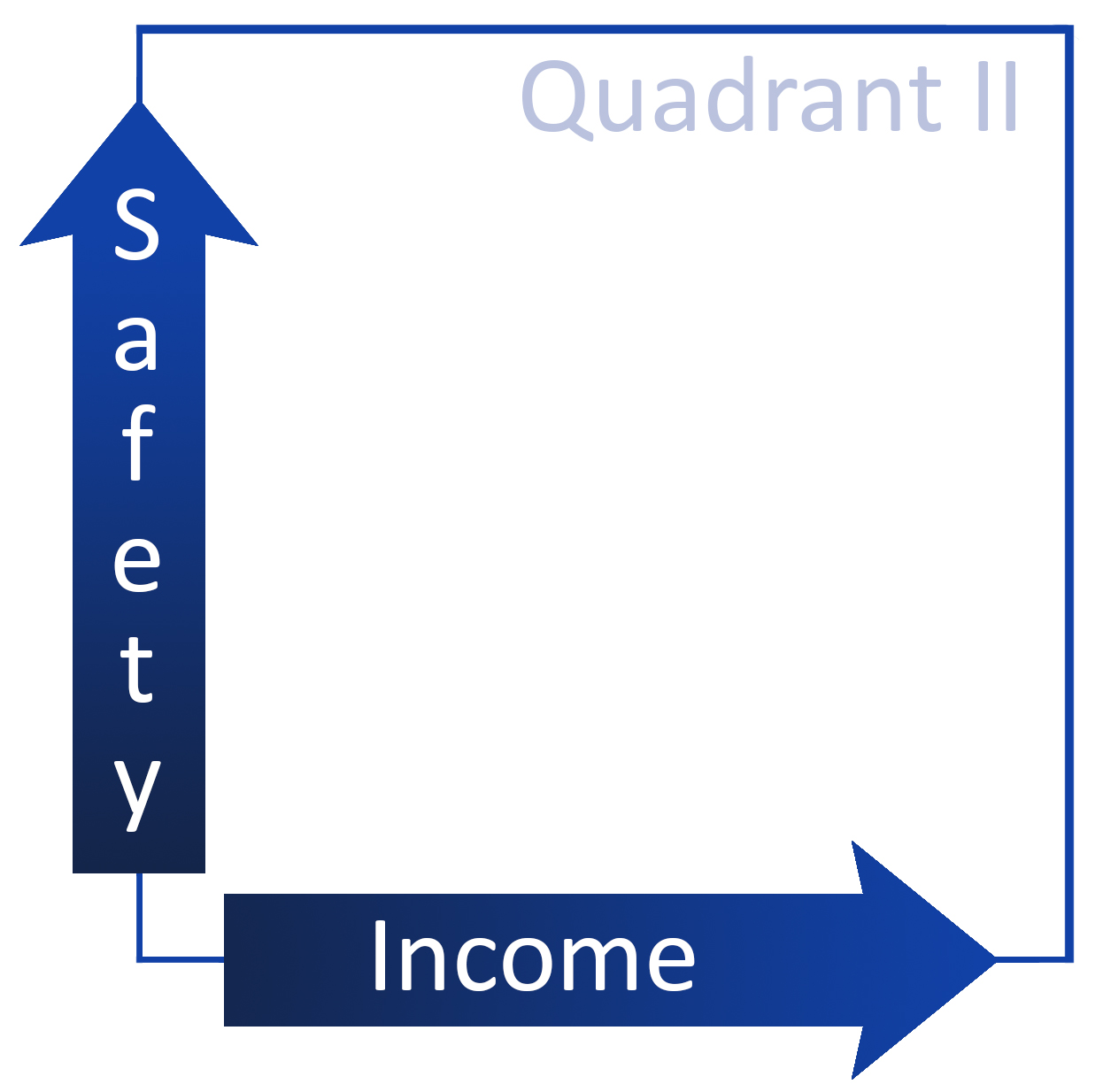

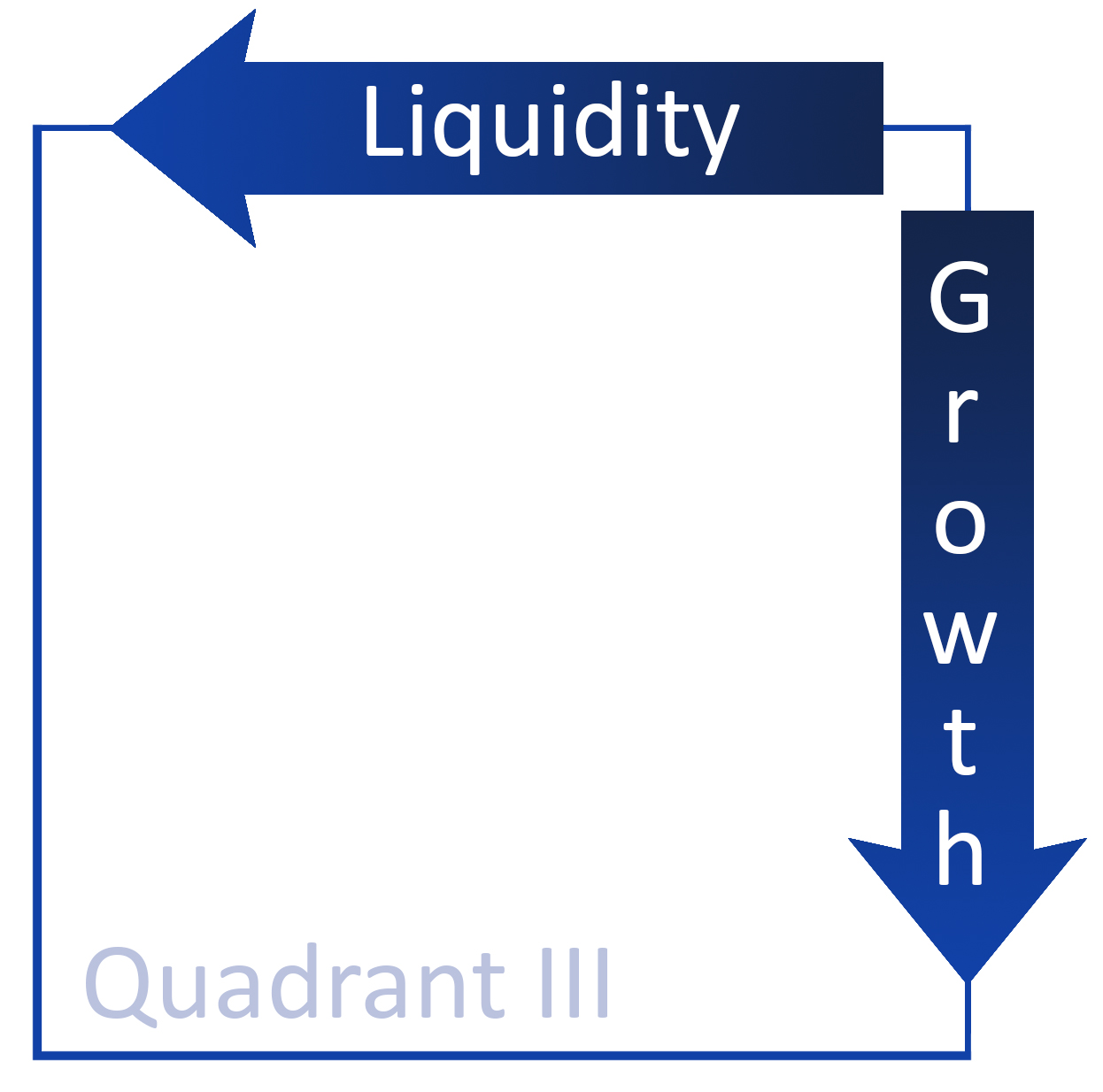

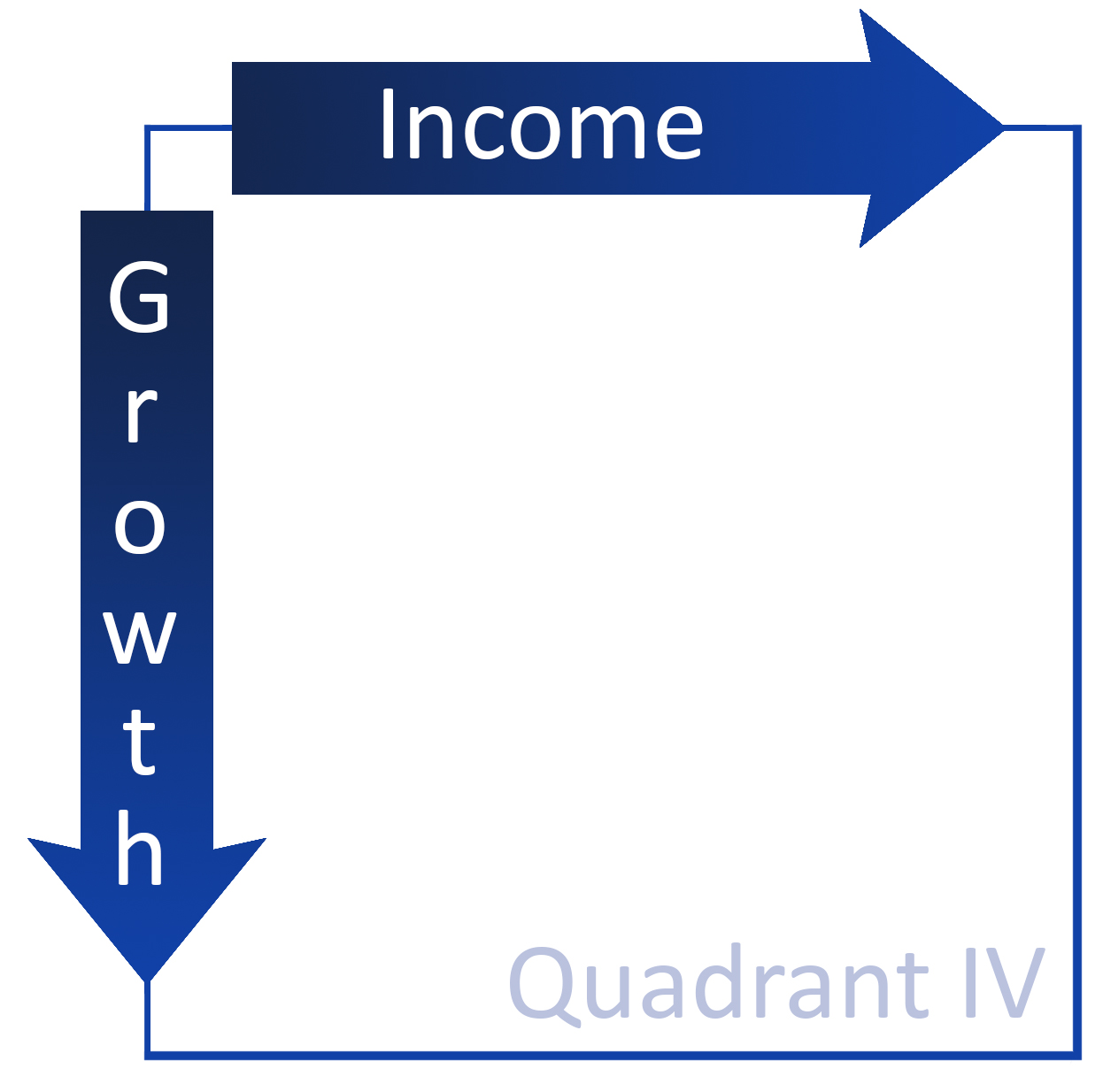

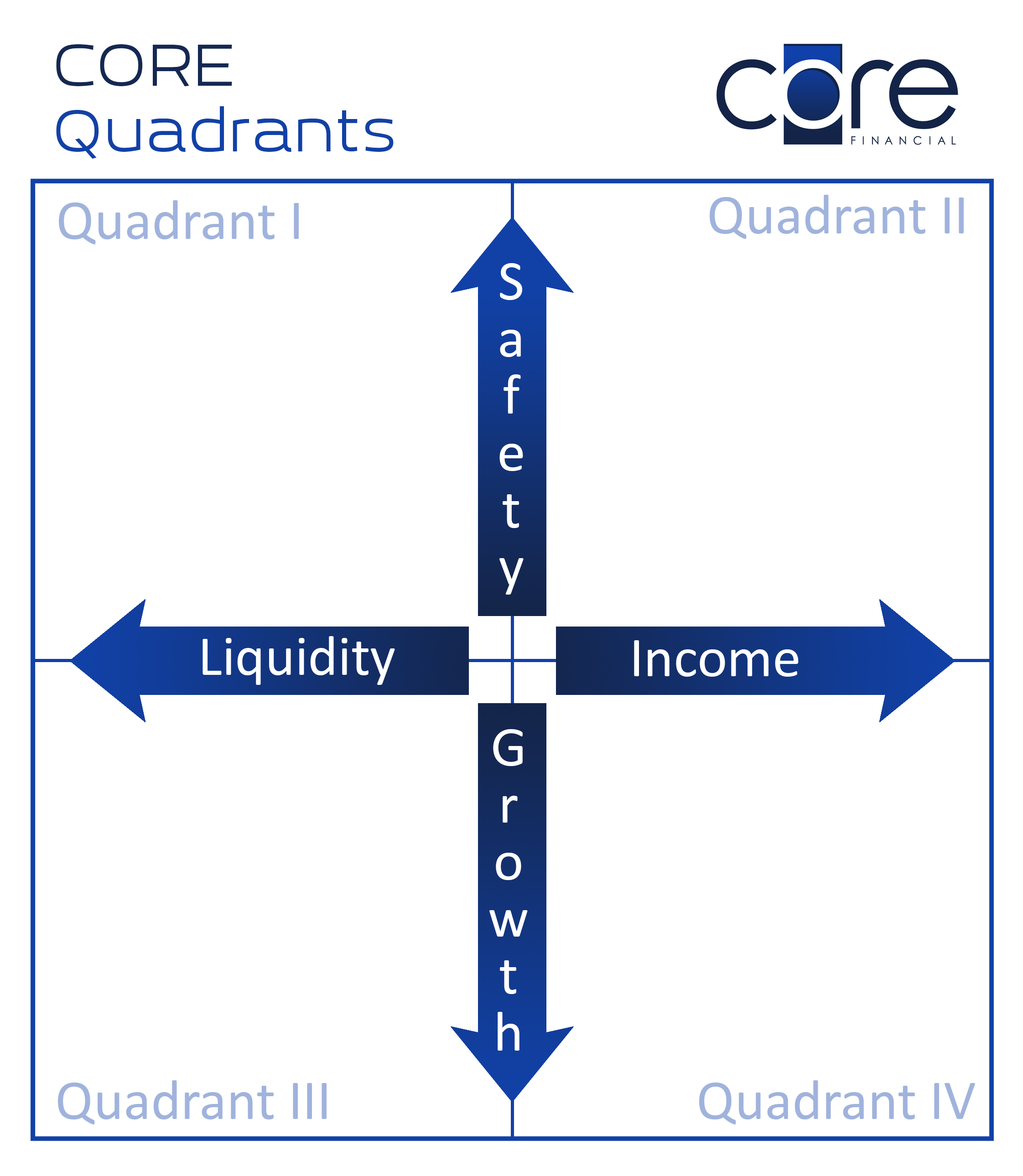

In addition to the standard practice of focusing on account-level diversification, we have created the CORE Quadrants™ diagram to help our clients visually focus on a broader level of diversification (i.e. ‘macro-diversification’) across the four vital, but often competing priorities of safety, liquidity, income and growth. By using the CORE Quadrants™ diagram to visually arrange your assets according to their individual characteristics, we can determine various non-market risks you may be exposed to, and how to better balance your overall portfolio from a macro standpoint.

In the CORE Quadrants diagram above, the top row is focused on safety, while the bottom row is focused on the competing goal of growth. The left column is focused on liquidity, while the right column is focused on generating income. If an asset is liquid and safe, it belongs in Quadrant I; if it is safe and generates income, it falls in Quadrant II. Assets that are liquid and focus on growth will land in Quadrant III, while Quadrant IV is reserved for assets that prioritize income and growth.

Click on each individual quadrant in the right sidebar to see a sample list of assets that might fall into each quadrant.